Russia's default… Factors related to the economic destruction of the war are evaluated through sanctions. At this point, S&P Global downgraded Russia's foreign currency credit rating from CC/C to "Selective Default". Default analyzes have been carried out for a while, based on Russia's desire to make bond coupon payments in rubles or blocked payments. As of Monday, the first technical default occurred in the coupon payment of a corporate bond. It was announced that Russian Railways JSC went into default due to failure to make its due payment last month. This is the first time such a decision has been taken for a company due to the great difficulties experienced in financial transactions after Russia was subjected to heavy sanctions.

Technical details in coupon payments… Although the situation on the ground remains uncertain, Russia is still the side that has a high probability of winning at the end of the day due to the surplus of resources. Of course, what will this gain be for and how, at what cost, will it be an achievement worth the loss? Russia is paying a huge economic price, and it seems that the Western world will create the checkpoints of the financial system in such a way that Russia will be made to default. In some of the coupon payments, the payments that were blocked in their bank accounts did not reach the bond buyers. Of course, there is the possibility of Russia taking this to international arbitration.

Bonds with a payment option in rubles are fine. In bonds without this option, the buyer may not accept the payment. There is a possibility that the bonds will default if the payment is made in rubles rather than dollars or euros, although the agreement does not allow it. After 30 days have passed, the payment of the bond goes into default and the insurance against the default risk comes into play.

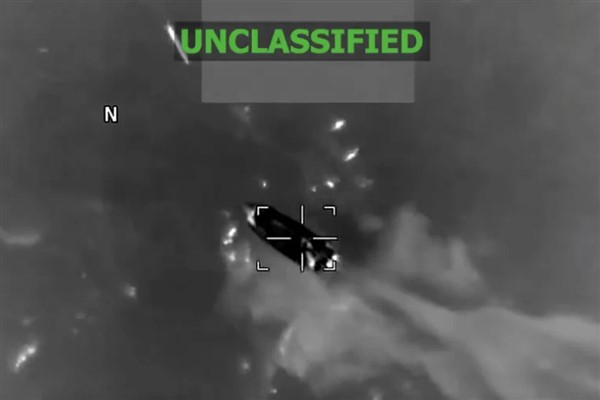

Russian government Eurobonds and bond coupon payments… Source: Bloomberg

Conclusion? Since Russia does not have access to reserves, it will need to use the oil revenues that it can transfer to the reserves to create foreign exchange. However, if the EU stops buying oil from Russia and Russian oil cannot be sold, this resource may also dry up. It is not known whether the EU will take this decision at the expense of its own recession, but it is more likely than a few weeks ago. Russia makes coupon payments, but due to the problems in correspondent banks due to sanctions in the international banking system, the payments do not reach their owners. The US financial system is quite compelling to default on Russia…

Kaynak Tera Yatırım

Hibya Haber Ajansı